- March 13, 2025

- 7:12 pm

For over a decade, the NYSERDA solar rebate has made switching to solar power more affordable for homeowners across New York City, Westchester, and Upstate NY. However, as of March 10, 2025, the current $0.20 per watt rebate has officially run out—marking the end of one of the longest-standing solar incentives in the state’s history.

How the NYSERDA Rebate Shaped Solar Adoption in NY

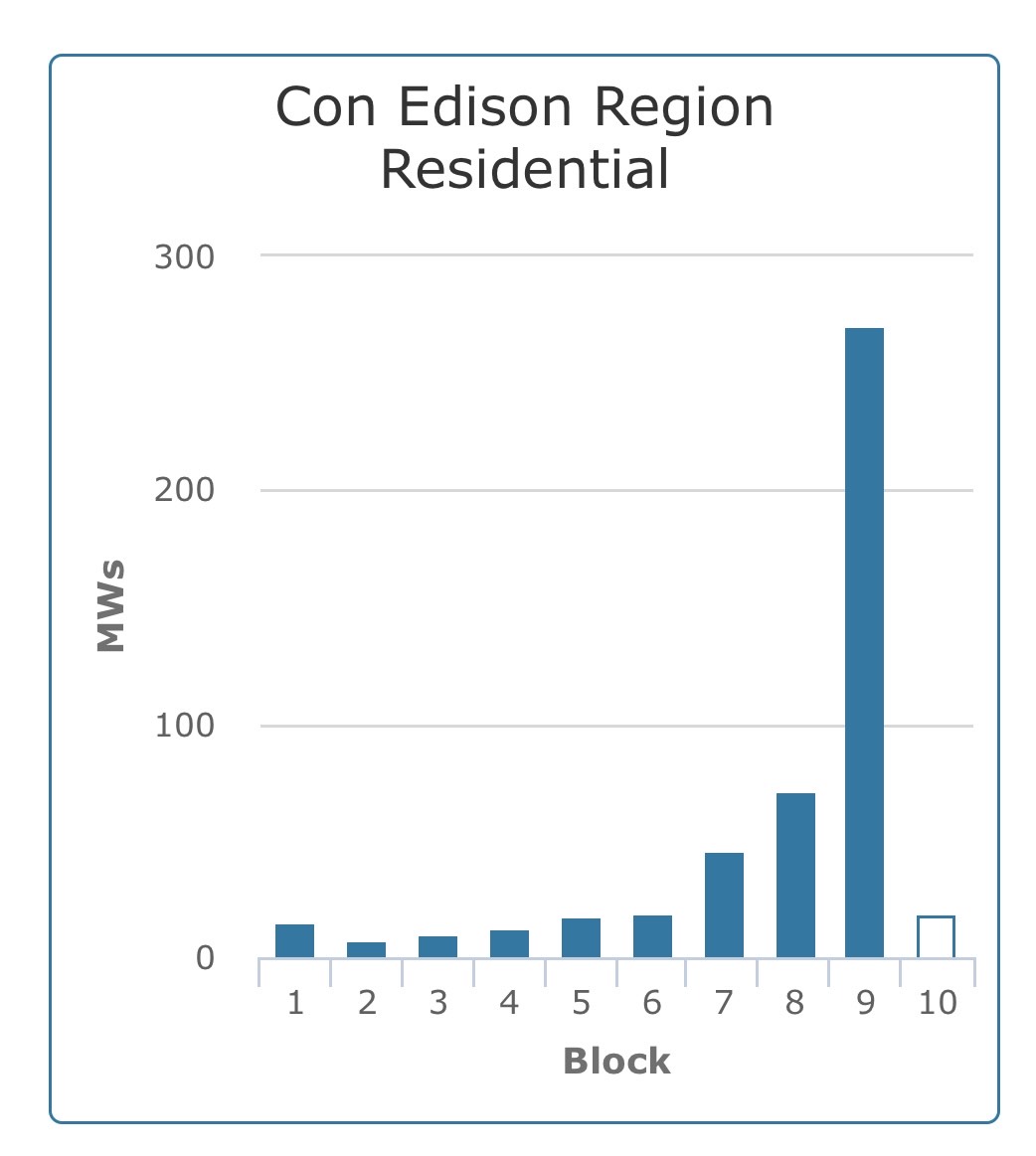

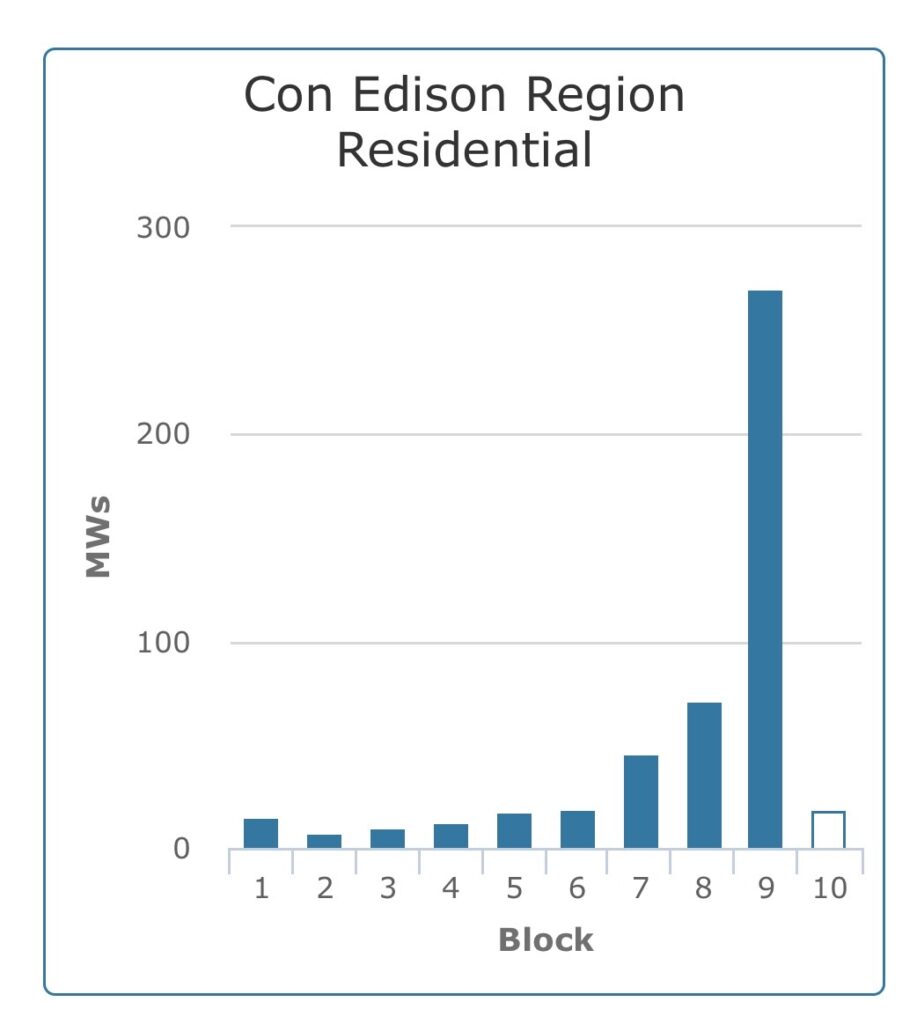

Since 2014, NYSERDA has played a crucial role in making solar more accessible. When the program first launched, the rebate was as high as $1.00 per watt, covering up to 14,000 kW and benefiting roughly 1,750 homeowners with an average discount of $8,000 per system. Over the years, as demand grew and funding limits were reached, the rebate gradually decreased:

• 2014 – Started at $1.00 per watt, then dropped to $0.90 after the first block.

• 2016 – Decreased to $0.50 per watt, with multiple blocks filling up in between.

• 2018-2025 – Held steady at $0.20 per watt, offering an average $1,000-$2,300 off per system.

Now, after funding 270,000 kW worth of solar installations—helping 27,000+ homeowners—the $0.20 rebate has been fully claimed.

The Future of Solar Incentives in NY

The good news? NYSERDA has historically never let the rebate disappear entirely. In fact, a new incentive block has already been introduced, albeit at a historic low of $0.15 per watt—the smallest rebate since the program began.

This follows a clear trend: every time an incentive reaches its limit, the next available rebate is lower. While today’s homeowners might not see the unprecedentedly high incentives of the past, they still have access to incentives that will disappear in the future.

Current Solar Incentives Available in NYC (2025)

Despite the reduction in NYSERDA’s rebate, NYC homeowners can still take advantage of a stackable set of incentives, including:

✔ NYSERDA Rebate: $0.15 per watt (new rate)

✔ Federal Tax Credit: 30% (for purchased or financed systems)

✔ NY State Tax Credit: 25% (capped at $5,000)

✔ Property Tax Abatement: 30% (spread over 4 years, starting the March after installation)

Don’t Wait—The Best Time to Go Solar is Always Now

With each passing year, solar incentives decline, and history shows that waiting means missing out. If you’re considering solar, now is the time to take advantage of today’s maximum available incentives before they decrease even further.

Call us today for a free consultation to find out what incentives you qualify for!